Adani’s personal wealth falls by $7 billion after the Hindenburg report

text_fieldsMumbai: After the US-based short-selling firm Hindenburg Research’s report of stock manipulation, accounting fraud, and financial irregularities, Billionaire Gautam Adani’s personal wealth fell by $7 billion to reach $119.5 billion on Wednesday.

Shares of Adani Group companies tumbled by up to 10% during the day following the negative report that said it has been short-selling Adani Group companies through US-traded bonds and non-Indian-traded derivative instruments.

Hindenburg report claimed that the key listed companies of the Adani Group have incurred huge debt by offering shares of their inflated stock for loans because of which the companies have been put into a precarious state.

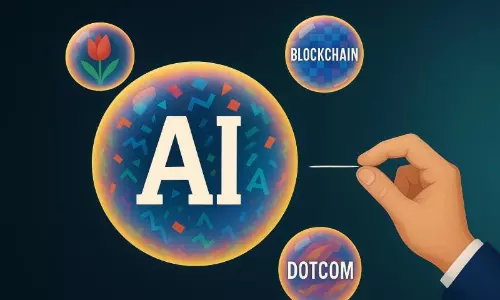

Short selling is used in stock trading as a mode of trade where a trader pockets those shares, the value of which declines in the market, at a lower price to sell them later in the open market. Short-selling can lead to potentially limitless losses since the price of a stock can keep rising infinitely.