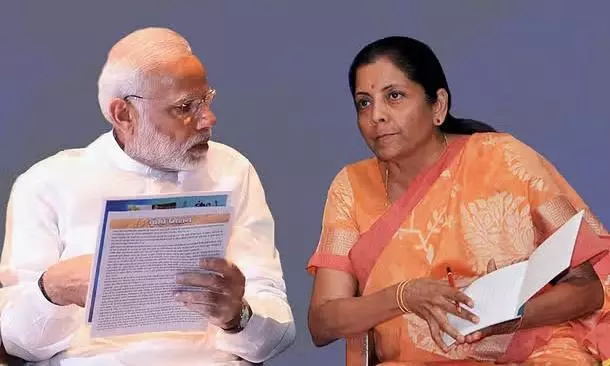

Rs 16.11 lakh crore written off under Modi: UPA prioritised farmers, not corporates

text_fieldsIndian banks wrote off a staggering Rs 16.11 lakh crore in the past decade under Prime Minister Narendra Modi’s leadership, according to recent data revealed by the Minister of State for Finance. This figure highlights the significant scale of non-performing asset (NPA) write-offs during the Modi administration and has drawn sharp criticism for favouring large industrialists while neglecting public welfare.

In stark contrast, the previous United Progressive Alliance (UPA) government wrote off around Rs 2 lakh crore over its decade-long tenure. This comparison underscores the exponential increase in bad loan write-offs under the National Democratic Alliance (NDA) government, which is nearly eight times higher than that of its predecessor.

Disparity in priorities

The Rs 16.11 lakh crore write-off is particularly notable when compared with the last major pan-India farm loan waiver of Rs 60,000 crore, announced in 2008 under the UPA. That initiative provided relief to lakhs of struggling farmers, many of whom faced mounting debts due to crop failures and financial distress. In contrast, the current government’s loan write-offs appear to have disproportionately benefited large corporations, including some with close ties to the ruling regime.

To put the scale of these write-offs into perspective, the amount is significantly larger than the cumulative budgets for health and education over the same period. Over the last decade, the Union government allocated 40% less for education and less than half of this amount for healthcare. Critics argue that this reflects a troubling prioritisation of corporate interests over the needs of ordinary citizens.

Public burden and bank practices

The massive write-offs have had a direct impact on the financial burden borne by the public. Banks, faced with mounting losses, have passed these costs onto depositors through increased service charges and higher interest rates on loans. Public funds have also been used to recapitalise banks, effectively making taxpayers shoulder the financial burden of corporate mismanagement and systemic failures.

India’s gross NPA-to-total advances ratio reached a peak of 7.85% during Modi’s tenure, far exceeding global norms. By comparison, countries such as South Korea and Canada report ratios below 0.3%, while Germany and the United States maintain figures around 1%. India’s disproportionately high NPA ratio has raised concerns about weak regulatory oversight and systemic inefficiencies in the banking sector.

Frauds and insolvency resolutions

Of the Rs 16.11 lakh crore written off, Rs 9.25 lakh crore were linked to large industries and services, with many cases tied to allegations of financial fraud, under-invoicing, and deliberate mismanagement. Critics have pointed out that the insolvency resolution process has often favoured corporate defaulters over creditors.

For example, in high-profile cases like Videocon and Reliance Communications, banks recovered as little as 6% and less than 1% of their respective claims of Rs 46,000 crore and Rs 49,000 crore. These recoveries, often referred to as “haircuts,” have been criticised as grossly inadequate, further eroding public trust in the banking system.

The Insolvency and Bankruptcy Code (IBC), introduced to streamline the resolution process, has faced backlash for enabling such significant haircuts. Experts argue that the system has been exploited to benefit large corporations while smaller borrowers, including farmers and small businesses, are held to stricter repayment terms.

Calls for reform and accountability

Despite several legislative amendments introduced under the Modi government, the rules enabling automatic write-offs remain unchanged. Critics have called for greater accountability in addressing NPAs and implementing measures to prevent fraud. Suggestions include creating a centralised monitoring system for financial frauds and enhancing the independence of regulatory bodies to reduce political and corporate influence.

The write-offs have also raised questions about the government’s commitment to transparency. While banks classify written-off loans as “technical write-offs,” allowing them to continue recovery efforts, data on actual recoveries remains sparse. This lack of clarity has fuelled public scepticism and demands for more stringent governance measures.

Broader implications

The staggering scale of these write-offs signals systemic issues in India’s banking sector that go beyond mere financial losses. Observers note that the continued bailout of large defaulters at the expense of public welfare programmes and essential services undermines both economic growth and social equity.

As the government pushes for further banking reforms, experts argue that the focus must shift from merely resolving NPAs to addressing the root causes of financial mismanagement. Strengthening oversight, improving accountability, and prioritising public welfare are essential steps to rebuild trust in India’s banking system.

This article is based on an opinion piece written by Jawhar Sircar, former Rajya Sabha MP of the Trinamool Congress, in The Wire.