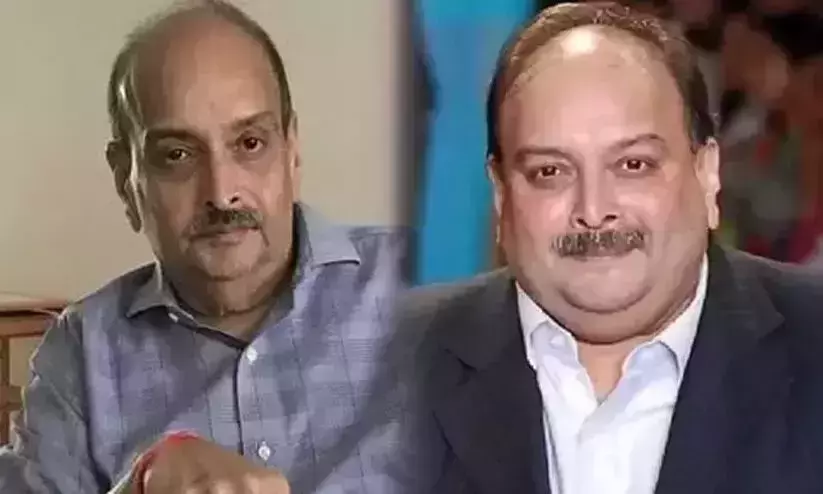

Mehul Choksi arrested in Belgium on India’s request for extradition

text_fieldsNew Delhi: Mehul Choksi, the absconding diamantaire linked to the Rs 13,000 crore PNB bank loan fraud case, was arrested in Belgium following an extradition request from Indian agencies, according to official sources on Monday.

The action against the second "prime suspect" in this case, after Choksi's nephew diamantaire Nirav Modi, was taken on Saturday based on an extradition request moved by the Central Bureau of Investigation (CBI) and the Enforcement Directorate (ED).

Choksi, who had been residing in Antigua since 2018 after fleeing India, was located in Belgium last year, where he claimed to be undergoing medical treatment.

Sources said the Interpol Red Notice against him for arrest was "deleted" sometime back, and the Indian agencies had been pursuing him via the extradition route since then.

Indian agencies have shared two open-ended arrest warrants, issued by a special court in Mumbai in May 2018 and June 2021, with Belgian authorities as part of the extradition process for Mehul Choksi.

Following his arrest, formal paperwork is underway, as Choksi is expected to apply for bail citing health concerns.

In 2018, Mehul Choksi, Nirav Modi, their family members, employees, and several bank officials were charged by the CBI and ED for their alleged involvement in the PNB loan fraud at the Brady House branch of the Punjab National Bank (PNB) in Mumbai.

It was alleged that Choksi, his firm Gitanjali Gems and others "committed the offence of cheating against PNB in connivance with certain bank officials by fraudulently getting the LOUs (letters of undertaking) issued and got the FLCs (foreign letters of credit) enhanced without following prescribed procedure and caused a wrongful loss to the bank".

Investigating agencies revealed that during March-April 2017, officials at PNB's Brady House branch in Mumbai issued 165 Letters of Undertaking (LoUs) and 58 Foreign Letters of Credit (FLCs), facilitating the discounting of 311 bills. These LoUs and FLCs were allegedly issued to Mehul Choksi's firms without any sanctioned limit or cash margin. Additionally, no entries were made in PNB's central banking system, effectively bypassing scrutiny in case of default.

Based on these LoUs by PNB, money was lent by SBI, Mauritius; Allahabad Bank, Hong Kong; Axis Bank, Hong Kong; Bank of India, Antwerp; Canara Bank, Manama; and State Bank of India, Frankfurt.

"Since the accused companies did not repay the amount availed against the said fraudulent LoUs and FLCs, PNB made the payment of Rs 6,344.97 crore (USD 965.18 million), including the overdue interest, to the overseas banks, which had advanced buyer's credit and discounted the bills against the fraudulent LoUs and FLCs issued by the PNB," the CBI's supplementary charge sheet in the PNB bank fraud case alleged.

The ED has attached or seized assets worth Rs 2,565.90 crore in the case against Choksi, and the court has allowed "monetisation" of all these properties.

(inputs from PTI)